Brian Jackson - Fotolia

HDD vs. SSD storage in the age of flash

HDDs continue to play a key role in the data center, even as SSD capacities increase and prices fall. See how HDDs and SSDs stack up in terms of price, capacity and use cases.

Calling the HDD market mature is as understated as describing Amazon CEO Jeff Bezos as "well off." The storage industry has been in the latter stages of a long-term transition from magnetic to solid-state storage, with shipments of HDDs peaking a decade ago. However, HDD vs. SSD storage unit sales don't tell the whole story, because overall bytes shipped have continued an upward march during this same time period.

Nevertheless, as SSD capacities have increased and prices declined, demand has shifted from HDD to SSD storage with I/O-intensive enterprise workloads, such as databases, the first to transition and client devices following as users shifted to laptops and tablets. The trend accelerates with every generation of SSD technology, with recent estimates showing only about 20% of enterprise HDD shipments going to mission-critical applications.

HDDs have found a niche in high-capacity drives for warm and cold storage. Drives in the 10 TB to 16 TB range are widely available, manufacturers' technology roadmaps project capacity expansion that should ensure a future for enterprise HDDs over the next decade.

State of HDD vs. SSD storage products

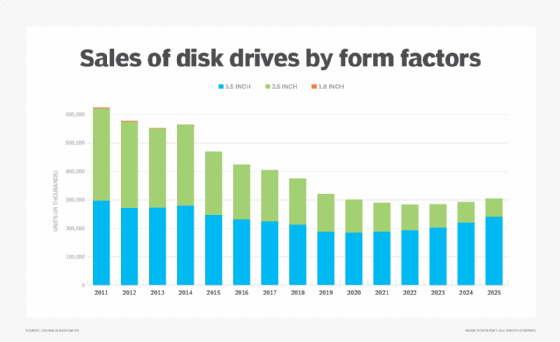

The SSD industry is going through a miniaturization trend as the M.2 form factor and ruler-style small form factor based on the Enterprise Data Center SSD Form Factor bring about size and density improvements compared with traditional 2.5-inch SATA devices. HDDs, on the other hand, haven't budged from the 3.5- and 2.5-inch form factors introduced three decades ago.

Estimates from Coughlin Associates show that the larger devices account for about 60% of the HDD market, a share Coughlin expects to increase through 2025. The preference for capacity over physical size is another indicator of HDD's place in the SSD era.

There are only three HDD manufacturers of consequence left -- Seagate Technology, Toshiba and Western Digital -- with Seagate and Western Digital trading the top spot depending on the estimate with about 40% each. The state of the art is 3.5-inch 16 TB drives using helium-filled assemblies. However, Western Digital and Seagate have announced 18 TB and 20 TB drives that will be available in 2020.

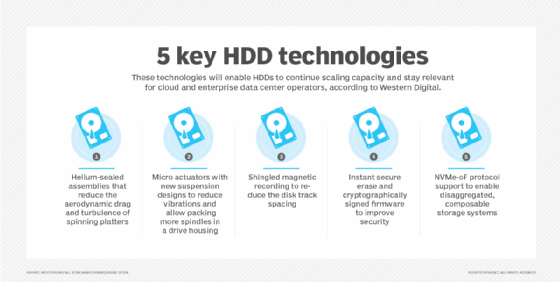

Longer term, Western Digital and Seagate are developing a replacement for the perpendicular magnetic recording technology used since the dawn of the HDD. Future drives will use some form of energy-enhanced recording -- either heat-assisted magnetic recording (HAMR) or microwave-assisted magnetic (MAMR) -- to increase the areal recording density. The two HDD giants are using different techniques, with Seagate going with HAMR and Western Digital developing MAMR drives, at least for the 18 TB to 20 TB generation. Energy-assisted recording along with tighter platter spacing, with up to nine platters per drive, provide HDD manufacturers with potential to achieve 50 TB drives by 2026.

HDD use cases

With most enterprises shifting the balance of IT infrastructure from exclusively on-premises systems to a mix of owned and rented cloud capacity, the use of HDDs for anything but long-term archiving will dwindle inside corporate data centers. SSDs will be large and cheap enough to handle any enterprise workload while providing superior performance and energy efficiency.

Hyperscale operators, including public cloud services and online services with enormous storage requirements, such as Dropbox, Facebook and Google, are another story. They will need HDDs to handle the continued demand for media storage. Hyperscale buyers are estimated to account for about half of all HDD sales, a ratio that will only increase over time. The primary HDD use cases are:

- rich media storage and streaming applications;

- backup storage for nearline disaster recovery, with massive tape libraries like AWS Glacier used for cold storage and long-term archive vaulting; and

- other warm, latency-insensitive applications, such as user directories for cloud file sync-and-share and collaboration applications.

The bottom line for HDD vs. SSD storage

HDDs still have a decided price advantage over SSDs, with 10 TB to 12 TB enterprise SATA drives going for $25 to $30 per terabyte. By contrast, 2 TB to 4 TB 2.5-inch and M.2 SSDs run about $100 to $150 per terabyte -- four-times as much. For applications like those outlined above that don't require low-latency, high IOPS performance, HDDs are the better choice.

Given rapid improvements in technology, enterprise users should let their existing HDD systems age gracefully. Be cautious when considering HDD system upgrades, which should only be made in the context of broader strategic choices about the role of cloud services for cold storage, DR and user file sharing. In general, SSDs are preferable for all new server and storage arrays used for business applications.

The same HDD vs. SSD storage heuristics apply to cloud users when configuring compute instances: Use SSD instances for applications and HDD for archival storage, particularly for images and video. Cloud users will generally be ignorant of the storage choices made by providers for SaaS applications since the provider optimizes the infrastructure according to the particular performance requirements and desired UX.